Featured

Table of Contents

However, keeping all of these acronyms and insurance kinds straight can be a headache - what is the difference between homeowners insurance and mortgage insurance. The complying with table positions them side-by-side so you can promptly differentiate amongst them if you get perplexed. Another insurance protection kind that can pay off your home loan if you pass away is a common life insurance plan

A is in location for a set number of years, such as 10, 20 or 30 years, and pays your beneficiaries if you were to pass away during that term. An offers insurance coverage for your entire life span and pays out when you pass away.

One common guideline is to intend for a life insurance policy that will certainly pay out approximately 10 times the insurance holder's income amount. You could pick to make use of something like the Penny method, which includes a household's financial debt, earnings, mortgage and education expenses to determine just how much life insurance policy is needed.

There's a reason brand-new property owners' mailboxes are typically pestered with "Last Chance!" and "Urgent! Action Needed!" letters from home mortgage defense insurance companies: Many only enable you to acquire MPI within 24 months of closing on your mortgage. It's also worth noting that there are age-related limitations and thresholds imposed by almost all insurance companies, that frequently won't offer older purchasers as many choices, will certainly bill them much more or might refute them outright.

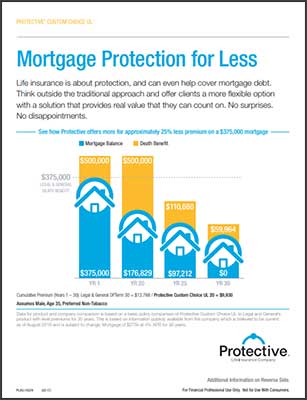

Right here's just how home mortgage defense insurance coverage measures up versus basic life insurance policy. If you have the ability to get approved for term life insurance policy, you should stay clear of home mortgage security insurance coverage (MPI). Compared to MPI, life insurance policy provides your household a more affordable and a lot more versatile advantage that you can trust. It'll pay out the very same amount anytime in the term a death occurs, and the cash can be used to cover any expenditures your household regards essential back then.

In those circumstances, MPI can offer terrific assurance. Just make sure to comparison-shop and review all of the great print prior to authorizing up for any kind of policy. Every home mortgage security option will have many regulations, laws, advantage options and drawbacks that require to be weighed very carefully versus your exact scenario (best mortgage protection insurance company).

Mortgage Cancellation Life Insurance

A life insurance policy can assist pay off your home's home loan if you were to die. It is among lots of ways that life insurance policy might assist secure your enjoyed ones and their economic future. One of the most effective ways to factor your home loan into your life insurance policy demand is to talk with your insurance agent.

Rather of a one-size-fits-all life insurance policy plan, American Domesticity Insurance policy Company uses policies that can be developed especially to fulfill your family members's requirements. Right here are several of your alternatives: A term life insurance coverage policy. first time buyer life insurance is energetic for a particular amount of time and usually uses a bigger quantity of coverage at a lower rate than a long-term policy

Rather than just covering a set number of years, it can cover you for your entire life. It likewise has living benefits, such as cash value build-up. * American Family Members Life Insurance policy Firm supplies different life insurance coverage policies.

Your representative is a wonderful source to answer your questions. They may likewise be able to assist you discover gaps in your life insurance policy coverage or brand-new ways to reduce your other insurance coverage plans. ***Yes. A life insurance policy recipient can choose to utilize the death benefit for anything - insurance on home loan. It's a great method to aid guard the monetary future of your family members if you were to die.

Life insurance coverage is one means of assisting your family members in paying off a home mortgage if you were to pass away prior to the home mortgage is totally repaid. Life insurance coverage profits might be utilized to aid pay off a mortgage, however it is not the exact same as home mortgage insurance that you could be needed to have as a condition of a lending.

Cheap Mortgage Payment Protection

Life insurance coverage may help ensure your home stays in your family by giving a death advantage that may aid pay down a mortgage or make vital purchases if you were to pass away. This is a brief description of protection and is subject to policy and/or biker terms and problems, which might vary by state.

Words lifetime, lifelong and permanent go through policy conditions. * Any kind of financings drawn from your life insurance policy policy will build up passion. mortgage guarantee premium. Any outstanding loan balance (car loan plus interest) will be deducted from the survivor benefit at the time of insurance claim or from the money value at the time of abandonment

** Subject to policy terms and problems. ***Discount rates may differ by state and company underwriting the car or homeowners policy. Discount rates may not put on all coverages on an automobile or home owners plan. Discounts do not relate to the life policy. Policy Types: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

Home mortgage security insurance policy (MPI) is a different type of guard that might be practical if you're unable to repay your home loan. Mortgage protection insurance policy is an insurance coverage plan that pays off the rest of your mortgage if you pass away or if you end up being impaired and can't function.

Like PMI, MIP shields the lender, not you. Unlike PMI, you'll pay MIP for the period of the lending term. Both PMI and MIP are needed insurance coverage coverages. An MPI policy is totally optional. The quantity you'll pay for home mortgage security insurance policy depends on a selection of factors, consisting of the insurer and the present equilibrium of your home loan.

Still, there are advantages and disadvantages: A lot of MPI plans are released on a "ensured approval" basis. That can be beneficial if you have a wellness problem and pay high rates for life insurance or battle to get coverage. insured mortgages. An MPI plan can provide you and your family with a sense of protection

Home Loan And Insurance

It can additionally be handy for people that do not receive or can not pay for a traditional life insurance policy. You can select whether you require mortgage protection insurance coverage and for for how long you need it. The terms usually vary from 10 to 30 years. You might desire your home loan security insurance policy term to be close in length to how much time you have entrusted to settle your mortgage You can terminate a home mortgage security insurance coverage.

Latest Posts

Burial Expense Insurance Companies

Burial Insurance Guaranteed

Life Insurance Online Instant Quotes