Featured

Table of Contents

Costs are normally less than entire life plans. With a degree term plan, you can pick your protection amount and the policy size. You're not locked into a contract for the remainder of your life. Throughout your policy, you never ever need to stress concerning the premium or survivor benefit quantities altering.

And you can not cash out your policy throughout its term, so you will not receive any kind of financial gain from your past coverage. Similar to other kinds of life insurance coverage, the price of a level term policy depends upon your age, protection needs, work, lifestyle and health and wellness. Normally, you'll locate a lot more budget-friendly coverage if you're more youthful, healthier and much less high-risk to insure.

Given that degree term premiums remain the same throughout of coverage, you'll recognize exactly just how much you'll pay each time. That can be a large assistance when budgeting your costs. Degree term protection also has some versatility, enabling you to tailor your plan with additional functions. These frequently come in the kind of motorcyclists.

You may have to satisfy details conditions and certifications for your insurance provider to enact this rider. There also can be an age or time restriction on the protection.

Is there a budget-friendly Level Term Life Insurance Premiums option?

The survivor benefit is normally smaller, and insurance coverage generally lasts until your kid turns 18 or 25. This cyclist may be an extra affordable means to assist guarantee your youngsters are covered as motorcyclists can commonly cover several dependents at the same time. As soon as your kid ages out of this coverage, it might be possible to transform the cyclist right into a new plan.

When contrasting term versus permanent life insurance policy, it is very important to remember there are a couple of various types. The most usual kind of irreversible life insurance is entire life insurance policy, however it has some vital differences compared to level term coverage. Below's a basic summary of what to consider when comparing term vs.

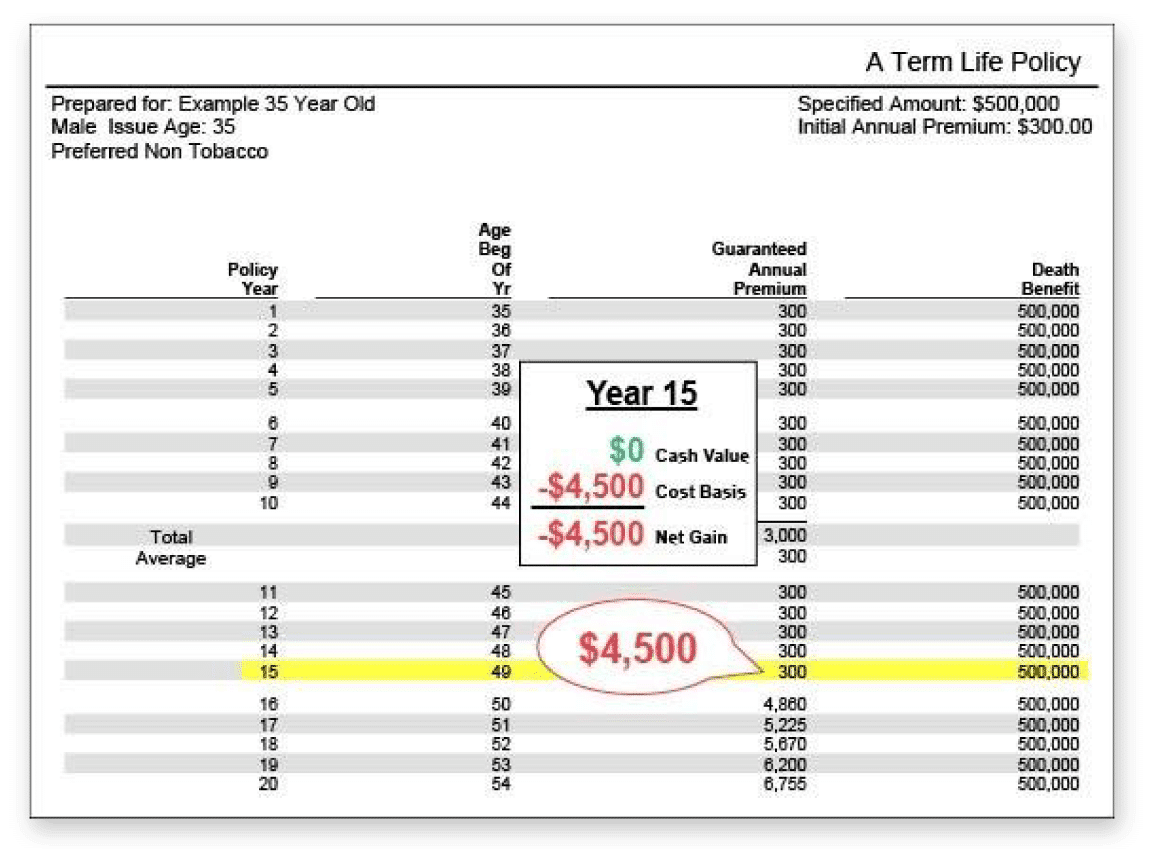

Entire life insurance lasts permanently, while term insurance coverage lasts for a specific duration. The premiums for term life insurance are normally lower than entire life insurance coverage. Nevertheless, with both, the premiums stay the exact same throughout of the plan. Entire life insurance coverage has a money worth element, where a section of the costs might expand tax-deferred for future demands.

30-year Level Term Life Insurance

One of the primary functions of degree term protection is that your premiums and your fatality advantage do not alter. You might have coverage that begins with a fatality benefit of $10,000, which could cover a home loan, and after that each year, the fatality benefit will certainly reduce by a collection quantity or portion.

Due to this, it's often an extra cost effective kind of degree term coverage., but it might not be enough life insurance for your needs.

After choosing a policy, finish the application. For the underwriting process, you may have to provide general individual, health and wellness, way of life and work information. Your insurance provider will certainly figure out if you are insurable and the threat you might offer to them, which is mirrored in your premium prices. If you're approved, authorize the documentation and pay your very first premium.

Consider organizing time each year to examine your policy. You might intend to update your recipient details if you've had any considerable life changes, such as a marriage, birth or separation. Life insurance coverage can sometimes feel complex. Yet you don't need to go it alone. As you discover your options, consider discussing your demands, desires and worries with a monetary professional.

Best Level Term Life Insurance

No, degree term life insurance policy doesn't have cash money value. Some life insurance policy plans have a financial investment feature that allows you to build cash money value with time. Level term life insurance companies. A section of your costs settlements is alloted and can earn rate of interest with time, which grows tax-deferred during the life of your coverage

These plans are commonly significantly much more pricey than term protection. If you reach the end of your policy and are still alive, the coverage ends. You have some options if you still desire some life insurance policy protection. You can: If you're 65 and your protection has actually gone out, as an example, you might wish to buy a new 10-year degree term life insurance policy policy.

Is 30-year Level Term Life Insurance worth it?

You might be able to convert your term protection right into an entire life plan that will certainly last for the remainder of your life. Lots of kinds of degree term plans are exchangeable. That means, at the end of your coverage, you can convert some or all of your policy to entire life coverage.

Level term life insurance policy is a policy that lasts a set term generally between 10 and thirty years and comes with a degree fatality advantage and level costs that remain the very same for the whole time the policy is in impact. This implies you'll know specifically just how much your payments are and when you'll have to make them, permitting you to spending plan accordingly.

Level term can be an excellent choice if you're looking to acquire life insurance policy coverage for the first time. According to LIMRA's 2023 Insurance Barometer Research Study, 30% of all grownups in the united state demand life insurance policy and don't have any type of policy yet. Degree term life is foreseeable and budget friendly, that makes it among the most prominent types of life insurance coverage

A 30-year-old male with a similar account can anticipate to pay $29 each month for the very same coverage. AgeGender$250,000 coverage amount$500,000 coverage quantity$1 million coverage amount20Female$15$23$34Male$19$29$4830Female$15$23$37Male$18$29$4940Female$22$35$61Male$25$43$7550Female$44$78$139Male$57$102$18860Female$108$194$355Male$149$268$500 Collapse table Method: Typical month-to-month prices are calculated for male and female non-smokers in a Preferred health classification acquiring a 20-year $250,000, $500,000, or $1,000,000 term life insurance policy policy.

Guaranteed Level Term Life Insurance

Prices may vary by insurance firm, term, protection quantity, health and wellness course, and state. Not all plans are readily available in all states. It's the most inexpensive kind of life insurance coverage for many people.

It enables you to budget plan and strategy for the future. You can quickly factor your life insurance policy into your budget since the premiums never ever change. You can plan for the future equally as easily since you recognize exactly just how much cash your loved ones will certainly obtain in case of your lack.

Is Level Term Life Insurance Companies worth it?

This is true for people who quit smoking cigarettes or that have a wellness problem that solves. In these cases, you'll normally have to go with a new application procedure to obtain a much better price. If you still require insurance coverage by the time your level term life policy nears the expiry date, you have a couple of alternatives.

Latest Posts

Burial Expense Insurance Companies

Burial Insurance Guaranteed

Life Insurance Online Instant Quotes